Start a High-Paying Accounting Career with Accounting Courses

According to the U.S. Bureau of Labor Statistics, an estimated 67,000 new positions for bookkeeping and accounting assistants are expected to be created by 2032. Entry-level salaries for these roles range from $45,000 to $55,000, with significant salary growth potential of 15% to 25%. While the cost of course certification can be a barrier for many, this article offers a variety of low-cost course options for you to consider.

What resources can help you invest in your future career?

Online and offline learning, choose which learning method to choose based on personal learning style, life arrangements and goals. These course sources hope that learners can concentrate on learning without taking on debt. The sources of accounting courses include:

Well-known online learning platform

Alison

Overview: This course covers essential accounting principles, including bookkeeping basics, financial statements, and the accounting cycle.

- There is no charge for the course materials, but there is a fee to obtain the certificate.

- The platform provides a comprehensive learning experience through video content and assessments.

edX

Overview: edX is a massive open online course platform created by MIT and Harvard. Take more than 260 online courses from the world's top universities and companies, including Introduction to Bookkeeping, a self-paced course that covers essential topics like trial balance and ledger accounts.

- Flexible learning pace and access to high-quality educational content.

- Earn valuable certificates from top universities and companies.

MyGreatLearning

Overview: Provides MIT accounting course materials for self-learners. In accounting courses, you can learn about credits and debits, financial statements, taxes, budgeting, reporting, and account management.

- Suitable for learners of different levels.

- Course content can be reviewed and reviewed at any time, supporting ongoing career development.

Offline Study

Job Corps

Overview: Job Corps is a vocational training and education program launched in the United States that offers career training in various fields, including accounting. The program covers foundational accounting principles, financial statement preparation, and the use of accounting software.

- Participants can earn industry-recognized certifications, helping them enhance their competitiveness in the job market.

- It also offers additional support services, such as career counseling, academic tutoring, and life skills training, to help students succeed in their careers.

American Job Centers

Overview: Local American Job Centers, which are supported by the U.S. Department of Labor, often offer training and career counseling, including accounting classes that cover basic accounting principles, financial statement preparation, accounting software applications and basic tax knowledge. Classes are often targeted at veterans, low-income individuals and others seeking employment support.

- Short-term study to obtain a certificate takes only 12 weeks.

- Provide opportunities for practical experience to help learners apply what they have learned in real work environments.

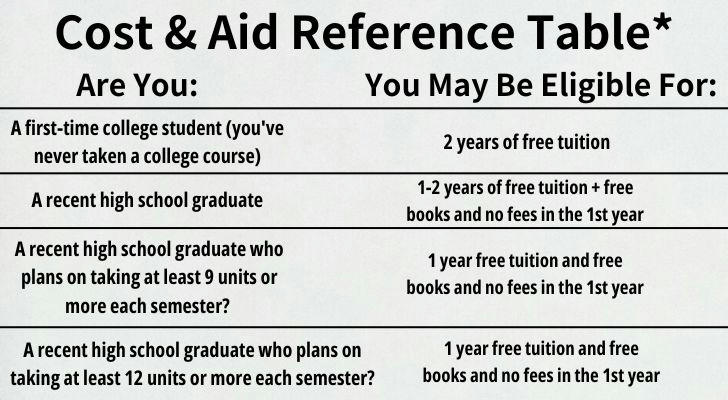

Community Colleges and Nonprofits

Overview: Accounting assistant programs offered by community colleges and nonprofit organizations are often targeted at low-income or unemployed people, who want to improve their skills for better job opportunities.

- Take Coastline College as an example. There is no need to worry about the cost.

In addition to funded course resources, you can also reduce financial stress through these fee assistance:

Federal Student Aid: Through federal student aid, the U.S. Department of Education provides more than $120 billion in grants, work-study funds, and low-interest loans to approximately 13 million students each year.

Scholarships: Many institutions and organizations offer scholarships based on merit or financial need.

Grants: A prominent example is the federal Pell Grant, which is designed to help low-income students. The average grant for all Pell Grant recipients nationwide is about $4,120.

How to Apply for an Accounting Program

Applying for an accounting program usually involves the following steps:

Visit the program's website: First visit the website of the program you are interested in studying to learn about the available courses.

Complete the application: Many programs require an online application. Be prepared to provide personal information, education background, and work experience.

Submit documents: Provide materials according to the website application requirements. For example, the employment center may ask for documents to determine whether you are eligible for their services.

Start training: After your application is successful, you will begin taking accounting courses, whether you study online or in person, and you can study at a pace to improve your skills.

Success Stories

Maria is a single mother from California who decided to switch to accounting to improve her financial situation.

She flexibly studied accounting courses through online platforms like Alison and edX and applied for federal student aid to cover the certificate fees. After completing the online courses, Maria participated in a local Job Corps program, receiving 12 weeks of accounting training.

Upon finishing the training, she successfully secured a position as an accounting assistant at a company, with an annual salary of $50,000.

Conclusion

With a variety of low-cost and easily accessible learning resources, such as online platforms like Alison and edX, as well as local programs like Job Corps and American Job Centers, aspiring students can find the right courses to suit their educational needs. Financial aid options, including federal student aid, scholarships, and grants, further ease the burden of course costs, making it easier for individuals to invest in their future careers.