Why Let Your Wallet Suffer? Pet Insurance: The Lifesaver for Your Pet and Your Bank Account!

Have you ever wondered what would happen if your furry friend suddenly needed emergency surgery? Would you be ready to fork over thousands of dollars, or would you rather have a safety net in place? Pet insurance isn’t just a luxury; it’s a necessity that can save you from financial heartache while ensuring your pet gets the care they deserve.

Why Choose ASPCA Pet Insurance?

Financial Protection: Pet insurance helps cover unexpected veterinary costs, afford necessary treatments without straining your budget.

Access to Quality Care: With insurance, you can opt for the best medical options for your pet, including advanced treatments and emergency care, without worrying about the costs.

Preventive Care: Many policies include coverage for routine check-ups and vaccinations, promoting your pet's overall health and helping to catch potential issues early.

More importantly, pet insurance will reimburse more than 80% of medical expenses.

What Does Pet Insurance Cover?

Pet insurance typically includes:

- Accidents and Injuries: Covers unexpected incidents, ensuring you can afford emergency care.

- Illnesses: From minor infections to serious diseases, insurance helps manage treatment costs.

- Surgeries: Whether routine or emergency, surgical procedures can be expensive, but insurance significantly reduces out-of-pocket expenses.

- Prescription Medications: Many plans cover necessary medications, making it easier to manage chronic conditions.

- Preventive Care: Some policies include wellness visits, vaccinations, and dental cleanings, promoting overall health.

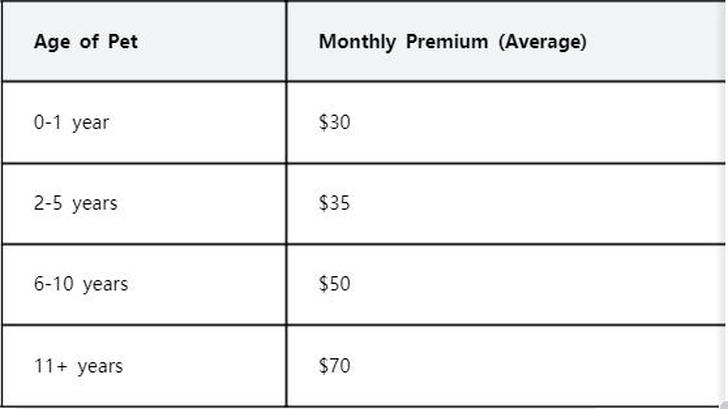

Cost Comparison of Pet Insurance by Age

No age or breed restrictions.

The Costly Reality: To Insure or Not to Insure?

Imagine this: a routine vet visit costs around $50, but an unexpected surgery could set you back anywhere from $1,000 to $5,000!!! Without insurance, many pet owners find themselves in a tough spot, forced to choose between their pet’s health and their financial stability. In contrast, those with pet insurance can breathe a sigh of relief, knowing that a significant portion of those costs will be covered.

Five Benefits of Pet Insurance

Financial Peace of Mind: With pet insurance, you can focus on your pet’s health rather than the bill. For instance, a $3,000 surgery could cost you only $300 out-of-pocket with a good insurance plan.

Comprehensive Coverage: Most plans cover accidents, illnesses, and even routine care. This means you can take your pet for regular check-ups without worrying about the cost.

Access to Better Care: Pet insurance allows you to choose the best treatment options without the financial burden. For example, a pet diagnosed with cancer can receive advanced treatments that might otherwise be unaffordable.

Preventive Care Options: Many policies now include wellness plans that cover vaccinations, flea treatments, and dental care, helping you keep your pet healthy from the start.

Peace of Mind for Emergencies: In emergencies, having insurance means you can act quickly without the stress of financial constraints. Imagine being able to say "yes" to a life-saving procedure without hesitation.

The Benefits of Insured vs. Uninsured Care

When it comes to veterinary care, the difference between insured and uninsured pet owners is stark. For instance, an insured pet owner might pay $200 for a $2,000 surgery, while an uninsured owner would have to pay the full amount upfront. This financial flexibility can mean the difference between life and death for pets needing urgent care.

Common Pet Illnesses and Their Consequences

Pets can suffer from various health issues, such as diabetes, cancer, or hip dysplasia. For instance, untreated diabetes can lead to severe complications, including kidney failure, which could cost thousands in emergency care. With pet insurance, you can afford regular check-ups and necessary treatments, preventing these dire situations.

Success Stories: The Power of Pet Insurance

1.Case of Bella the Beagle: Bella needed emergency surgery for a foreign object ingestion. Her owner, with insurance, paid only $200 instead of the $3,000 bill. Bella is now back to her playful self!

2.Max the Golden Retriever: Max was diagnosed with hip dysplasia. His owner’s insurance covered 80% of the $4,000 surgery, allowing Max to live a pain-free life.

3.Luna the Cat: After a sudden illness, Luna’s treatment cost $1,500. Thanks to her insurance, her owner only paid $150, making it possible to afford her ongoing care.

Conclusion: Protect Your Wallet and Your Pet’s Life

In a world where unexpected vet bills can lead to tough choices, pet insurance stands out as a smart investment. It not only protects your wallet but also ensures your furry friend receives the best possible care. Don’t wait for a crisis to realize the importance of pet insurance—act now and give your pet the gift of health and happiness!