Blacklist Loan Your Fast Cash Emergency Money

Do you need money urgently? Even if you are on the blacklist now, Blacklist Loan can still lend you money. Just fill in the necessary information and the money will be deposited into your account within 24 hours to help you through the difficult times. No need to wait any longer. It is safe and trustworthy. 1.2 million Canadians have chosen it

🔹What Are Blacklist Loans?

Blacklist Loans are specialized financial products tailored for Canadians who’ve been labeled “high-risk” due to poor credit scores, late payments, defaults, or even bankruptcy. Traditional lenders often reject these applicants, leaving them stranded during emergencies. However, alternative lenders offering Blacklist Loans focus less on credit history and more on your ability to repay today. By evaluating factors like income, employment stability, and banking behavior, they provide access to funds without the stigma of a low credit score. In 2025, over 1.2 million Canadians have turned to Blacklist Loans to cover urgent expenses, proving that financial setbacks don’t have to be permanent.

🔹Benefits of Blacklist Loans

Why choose a Blacklist Loan over other options? Here’s what makes them stand out in 2025:

- No Credit Checks: Traditional credit reports aren’t the deciding factor. Lenders use alternative data to assess eligibility.

- Lightning-Fast Approval: 89% of applicants receive approval within 2 hours, with funds deposited in under 24 hours.

- No Collateral Required: Most Blacklist Loans are unsecured, meaning you won’t risk losing assets like your car or home.

- Credit Rebuilding Potential: Repayments are reported to credit bureaus in 67% of cases, helping rebuild your score over time.

- Flexible Loan Amounts: Borrow between $200 and $20,000, depending on your income and needs.

For Canadians trapped in the cycle of bad credit, these loans aren’t just quick fixes—they’re tools for regaining financial control.

🔹How Do Blacklist Loans Work?

Blacklist Loans operate on simplicity and speed. Here’s the 2025 breakdown:

✅ Application: Complete a 5-minute online form with basic personal, employment, and banking details.

✅ Assessment: Lenders analyze your income (minimum $1,800/month in most provinces) and recent bank transactions to gauge repayment capacity.

✅ Approval: Algorithms provide instant decisions, bypassing lengthy manual reviews.

✅ Funding: Once approved, 92% of borrowers receive funds via Interac e-Transfer or direct deposit within 4 hours.

✅ Repayment: Choose biweekly or monthly installments over 6–24 months. Some lenders even adjust due dates to align with paychecks.

This streamlined process ensures you’re not left waiting when emergencies strike.

🔹The Blacklist Loans Application Process: Quick, Simple, and Stress-Free

Applying for a Blacklist Loan in 2025 is easier than ordering takeout:

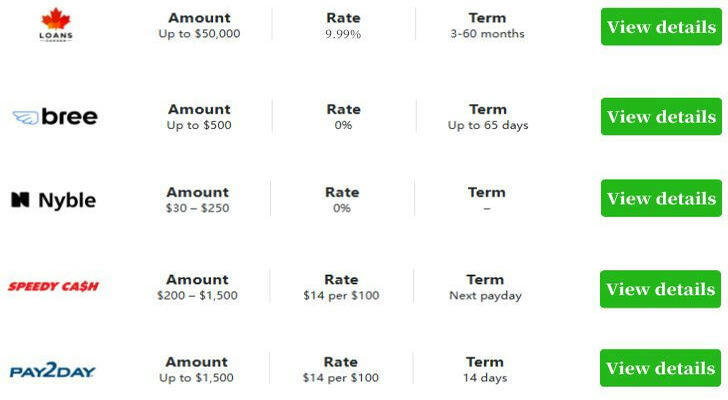

1️⃣ Research Lenders: Compare trusted providers like MapleFast Loans or TrueNorth Lending, checking for provincial licensing and customer reviews.

2️⃣ Check Eligibility: Ensure you meet criteria like minimum income (varies by province) and Canadian residency.

3️⃣ Submit Documents: Provide a government ID, recent pay stubs, and 3 months of bank statements—all uploadable via smartphone.

4️⃣ Sign Digitally: E-sign the agreement after reviewing terms (average APR: 19–39%, lower than 2021’s 45% peak).

5️⃣ Get Funded: Money hits your account swiftly, often before the day ends.

No queues, no paperwork, no judgment—just solutions.

🔹A Real-Life Success Story: How Blacklist Loans Saved Sarah’s Winter

Sarah, a single mom in Toronto, faced a nightmare in January 2025 when her furnace broke during a -30°C cold snap. With a 580 credit score, banks rejected her—until she found Blacklist Loans Canada.

- 10:00 AM: Applied during her coffee break.

- 10:15 AM: Approved for $3,500 at 31% APR.

- 2:00 PM: Funds arrived. By 5:00 PM, a technician installed a new furnace.

Sarah repaid the loan in 12 months, improving her credit score by 80 points. “It wasn’t just a loan,” she says. “It was peace of mind.”

🔹Blacklist Loans FAQs: Your 2025 Questions Answered

Q1: How do I avoid scams when choosing a Blacklist Loan lender?

- Verify their license with your provincial regulator (e.g., FSRA in Ontario).

- Check for physical addresses and avoid lenders asking for upfront fees.

Q2: What if I miss a payment?

- 2025 lenders often offer a 3-day grace period. After that, contact them immediately—73% negotiate revised plans without penalty.

Q3: Will Blacklist Loans appear on my credit report?

- Yes, if the lender reports to Equifax or TransUnion (most do). Timely payments can boost your score by 50–100 points annually.

Q4: Are interest rates higher for Blacklist Loans?

- Rates average 19–39% in 2025, down from 2021 due to stricter regulations. Still, compare multiple offers to save.

Financial Freedom Is Possible—Even on the Blacklist🎉

In 2025, Blacklist Loans have transformed from last-resort options into powerful tools for empowerment. With 4.3 million Canadians now using alternative credit products, the stigma around poor credit is fading. Whether you’re recovering from a layoff, medical crisis, or past financial missteps, these loans offer more than cash—they offer a second chance. Ready to take control? Your solution is just a few clicks away.